Average 2 Year Fixed Mortgage Rate Has Increased To 4.09% (Source: The Sun)

Financial information company Moneyfacts have released figures this week that show that the average 2 year fixed mortgage deal rate now stands at over 4%! Specifically 4.09%. The highest average rate for almost 10 years.

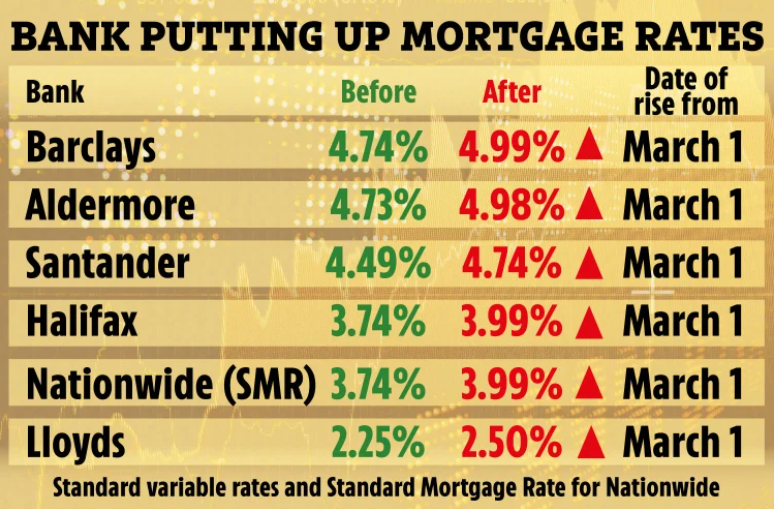

Since the Bank of England increased the base rate earlier this month from 1.25% to 1.75%, the average 2 year fixed mortgage product rate has increased by 0.14%. Shockingly the average two-year fixed rate was 2.34% in December 2021. So it has increased by 1.75% in 2022 so far with 4 months left to go. Moneyfacts also reports that the overall five year fixed rate mortgage average has gone up by 0.16% since the beginning of August 2022 to 4.24%, a rise of 1.60% compared to December 2021, when it was at only 2.64%.

Although a lot of mortgage customers often chose to secure a five year fixed rate with a lender to avoid any astronomical rate increases, the difference between an average 2 year fixed and 5 year fixed has decreased by 0.30% meaning that the benefit of choosing a 5 year fixed over a 2 year has decreased.

What Do Moneyfacts Say?

Representative and finance expert from Moneyfacts Eleanor Williams has said: “The average shelf-life of a mortgage product had sunk to a record low of just 17 days at the start of this month. In the aftermath of another base rate increase since then, providers are continuing to react with further revision of their offerings. The level of choice has reduced, dropping by 269 products and leaving 4,138 on sale currently. We have seen lenders withdraw parts of, or entire product ranges, with a number citing the pause in lending being due to unprecedented demand. Providers need to manage their service levels following an influx of applications, as borrowers have rushed to secure deals before rates have a chance to climb even further.

For consumers hoping to mitigate some of the impact of the ongoing cost of living crisis with a new fixed deal, seeking advice may well be wise as this remains a very changeable landscape, and ensuring they select a product that suits their future plans and priorities is crucial. Locking in to a decade-long fixed deal could be a double-edged sword; mortgage rates are currently on an upwards trajectory and there is anticipation that further base rate rises could impact the sector, so securing a long-term, stable fixed rate deal may well be foremost in many consumers’ minds. However, there may equally be others who believe rates could fall over that time, and as many deals in this sector carry hefty early repayment penalties, some may be concerned they may be tied in to a higher rate and repayments, should cheaper deals resurface down the line.”

What Do The Experts Say About The Average 2 Year Fixed Mortgage Rate

Oportfolio mortgages based in South West London had this to say: “These are certainly shall we say…interesting figures coming out of Moneyfacts. Interesting in the sense that although the average 2 year fixed product seems quite high, we as a whole of market lender are now more important than ever to existing mortgage borrowers and new borrowers. Statistically if you go to your own high street bank to secure your mortgage, you are more likely to go onto one of these really high mortgage rates as you are limited to that one lender. By speaking to a mortgage advisor such as ourselves who has access to over 90 different mortgage lenders, we can help you to find the lower rates offered by banks and get you the best deal possible.

We have been seeing rates rise and rise for months and unfortunately it doesn’t look like they will decrease any time soon however, now is a better time than ever to look at remortgaging so that you can fix a new rate and product now in case rates start to go up significantly more. With our help, you can get a new fixed deal that will be secure throughout the next few years and that we can help you to re-look at when rates inevitably go back down again.

If you or anyone else you know is interested in taking a look at your current mortgage deal, please give our advisors a call today to see how we can help.