Bank of England raise interest rates (Source: https://www.bbc.co.uk/news/business-12196322)

This afternoon, the monetary policy committee of the Bank of England has announced their intention to raise interest rates from the 11th time in a row after an unexpected rise in inflation. Inflation, which is a general increase in prices and decrease in the purchasing value of money, has been increasing month on month for the past couple of years due to many inside and outside factors. As a means of trying to reduce inflation, the Bank of England increases interest rates and discourages spending.

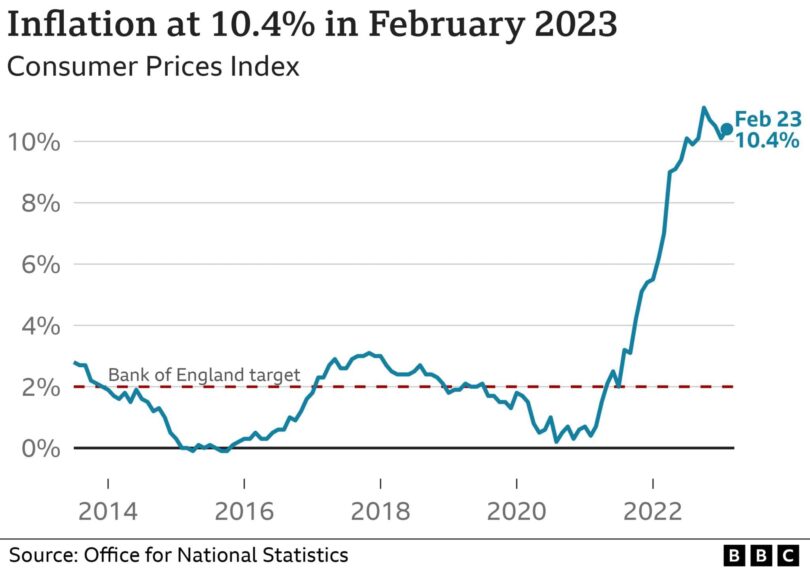

The last time that the Bank of England increased rates, inflation had already started to come down and it looked like things were going in the right direction and that it could have been the last rate increase for a while. However, recent figures released by the ONS and other data recording organisations show that inflation has actually increased from 10.1% in January 2023 to 10.4% in February 2023. Not a huge increase, but an increase none the less, which is not what we want to see. This comes after rates hit a 41-year high of 11.1% back in October 2022. The Bank’s current target for inflation is 2%, so obviously the country has a long way to go.

What Will The Bank of England Raise Interest Rates To?

Fortunately, despite rates being increased, they have only raised by 0.25% from 4% to 4.25%. In previous months we have seen much higher increases. What does that mean for interest rates in general? Well unfortunately that does mean that things will keep getting more expensive in most cases, the price of food, energy, utilities etc. will all likely go up.

When it comes to mortgages, we will have to wait and see. Since the last rate increase there has been a little bit of instability in the market, but generally rates have either stayed the same of continued to fall, which is great to see. We expect and hope that this will continue as lenders realise that the apetite for mortgages and the borrowers ability to pay them still remains. They should see that there is no real reason to increase their rates as they can still make a profit without massively inflating the products they offer.

Concerned About The Bank of England Raising Interest Rates?

If you or anyone you know is worried about the rise in interest rates and what this could mean for your personal finances, please give our team of financial advisors a call today. We are here to help.