Is an emergency base rate rise on the cards? (Source: www.bankofengland.co.uk)

Could we see an emergency base rate rise imposed on us by the Bank of England? Liz Truss’s new Conservative government and her recently appointed Chancellor’s mini budget released at the end of last week has caused the economy to go into a state of panic and now the pound has dropped to record low values. So what could happen next with base rates and mortgages?

Bank of England Base Rate

We’ve covered this before in previous articles, but what is the Bank of England’s base rate? Simply put, it’s the rate the Bank of England charges other banks and lenders when they borrow money. The base rate influences the interest rates that many lenders charge for mortgages, loans and other types of credit they offer people, so that they also don’t lose out on money themselves. So, if the Bank of England increases their base rate, the rest of the lenders will in order to keep up with them and not lose money.

When the country is in a state of inflation (rising prices), the Bank of England increases the base rate so that people borrow less, spend less, and save more. If people spend less on things like goods or energy services, the rate in which their price increases slows down. Due to lots of factors, primarily the fallout of the COVID-19 pandemic and the war in the Ukraine, spending is high and energy bills have increased exponentially. This means that in the last 9 months or so, the Bank of England has increased the base rate significantly.

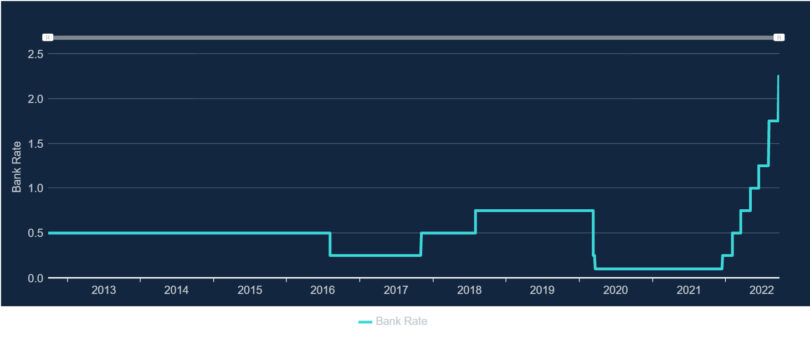

From March 2020 until December 2021, the base rate was at 0.1% but since December it has increased to 2.25% which only happened a couple of weeks ago. Normally the base rate is set after the regular meeting of the Monetary Policy Committee at the Bank of England once a period of time has passed to see if things have changed at all in regards to inflation. However, recent events have seen people questioning whether or not an emergency base rate rise is on the cards to save the economy.

Base Rate Rise On The Cards?

After the government’s announcement last week that they would be cutting taxes, among other money saving policies, the pound has dropped to very low value levels compared to other countries currencies. Compared to the US dollar, the pound was only worth $1.03, a low not seen since 1971, before rising slightly to sit at $1.07 today. The government’s tax cutting manifesto means that people will have more money to spend. Something that the Bank of England definitely does not want during a period of rising inflation as mentioned above. So could this mean that they will announce another rate hike imminently?

A recent statement from the Monetary Policy Committee said:

“As the MPC has made clear, it will make a full assessment at its next scheduled meeting of the impact on demand and inflation from the Government’s announcements, and the fall in sterling, and act accordingly. The Bank of England will not hesitate to change interest rates as necessary to return inflation to the 2% target sustainably in the medium term, in line with its remit.”

What Do The Finance Experts Say?

Louis Mason, content and communications manager at Oportfolio mortgages comments:

“It’s a case of WHEN and not IF the base rate will increase unfortunately. Everyone wants more money in their pocket, and that’s clearly what the government are trying to do, to help out people who are struggling. But that is exactly the opposite of what the Bank of England are saying the economy needs.

A reduce in spending will lower the rate in which prices are increasing for goods and services. Giving people more money to spend is probably not the answer. Will we see an emergency rate rise? I think so. And it won’t be the last one. But the Bank of England know what they are doing and hopefully we will start to see it working soon and we can get the economy under control.

In terms of mortgages, if you have a mortgage that is reaching the end of it’s fixed period, contact a mortgage advisor now! Don’t wait. Now is the time to remortgage before it’s too late. If your fixed product ends, you will either fall onto the lenders standard variable rate which is directly influenced by the Bank of England’s base rate and can be incredibly high. Or, you will be forced to quickly chose another fixed rate which, by the time the base rate has increased again, could be very high. Give Oportfolio a call today to see what deal we can get you on your remortgage.”

If you or anyone you know is in need of a remortgage, or simply wants to check that they are getting the most out of their current deal, please give our team a call today to see how we can help with expert mortgage advice.