The Great Debate. Interest-Only vs Capital Repayment Mortgages (Source: The Times)

What is the purpose of a mortgage? Is there a clear definition? Most people would define a mortgage as a loan provided by a bank, building society, or private finance company to purchase a property when immediate funds are not available.

As a loan, this money will normally need to be paid back at some point and all lenders will charge interest on the loan so that they can make a profit. The majority of mortgage customers and potential customers would expect to pay their loan per month until they either clear the balance of the mortgage or sell the property. Simple, right? But is there another alternative to repaying the loan per month? A more manageable payment method? In this piece we will discussing the advantages and disadvantages of an interest-only vs repayment mortgage.

Interest-Only or Capital Repayment

Let’s start by getting a clearer understanding of each type of mortgage payment method so that we are all on the same page. Although there are other ways that people can pay a mortgage, the two most common are either a capital repayment mortgage with interest or a purely interest-only loan with no capital repayment element.

Repayment Mortgage

With a repayment mortgage you will repay the loan back per month over a period of time. At mortgage application stage, the amount you will pay back and the period of time you have to pay the loan back will be determined by the lender and your mortgage advisor. A generic mortgage term is normally around 25 years however this could be extended to up to 40 years with some lenders or as low as 5 years with others depending on your affordability.

So, for example if you borrowed a £300,000 mortgage and you took it out over 30 years, without interest your repayment of the loan would be £833 a month. However, as expected, the mortgage lender won’t just give you free money, so they want to make a profit on the loan. An interest rate will be applied to the loan and on top of the capital repayment figure (£833) you will pay interest.

These interest rates are currently anywhere between 1% and 6% depending on the product and lender and can be influenced by The Bank of England base rate and inflation. With this in mind then, if we applied an example interest rate of 2% to this loan, your capital repayment and interest per month would be £1,109.

According to the Financial Conduct Authority, 70.6% of residential properties were mortgaged on a repayment basis. There are a lot of benefits to structuring your residential mortgage payments like this and that is why repayment and interest remains the most popular home mortgage payment option in the UK.

Interest-Only Mortgage

With an interest-only mortgage, things are a little different and there are a few things that will need to be considered before making the decision to proceed on this basis. This is where a qualified and experienced mortgage advisor comes in handy! As we’ve already mentioned, with an interest-only mortgage, you literally just pay the interest on the loan per month and don’t actually pay any of the loan capital back to the lender.

So, using the same mortgage scenario as above, you would only pay £500 a month for your interest-only payments but would not pay off any of the loan. As you aren’t repaying any of the loan, you will need to pay back the loan at some point and normally this is either done at the end of the mortgage term or if you sell the property. Either way, you will need to pay back a lump sum at some point which may be something you might want to consider.

What are the advantages and disadvantages of capital repayment vs interest-only?

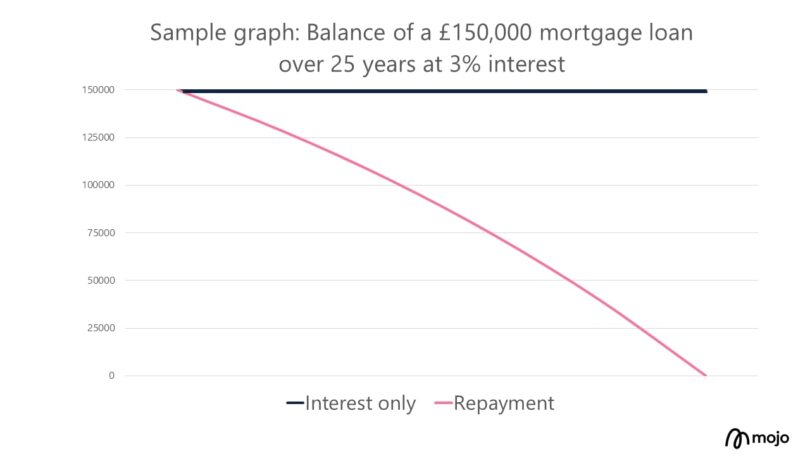

Graph Comparing Interest-Only vs Capital Repayment Mortgages (Source: Mojo)

With the many advantages of each payment plan naturally comes disadvantages and when you apply for your mortgage through your chosen mortgage advisor, they should give you a concise and thought-out advice document that weighs up these pros and cons in your specific situation. Let’s start with repayment mortgages:

- Pro: You own your home at the end of the mortgage term

This is a given. Of course, everyone who purchases a property, whether it’s to live in or rent out wants to actually own the property and not owe anyone money. With a repayment mortgage, yes it may take you 25-30+ years to pay the loan back in its entirety but at the end of the term you will completely own the property.

- Pro: You pay less interest as the amount owed decreases

The interest charged on the capital repayment and interest mortgage is based on the amount that you still owe the bank so obviously, as you pay more and more of the loan back to the lender the balance will reduce, and the interest will be based on a lower balance.

- Pro: You can often qualify for better deals as your balance falls

As your balance decreases your loan to value will decrease and often lenders will offer lower rates and other benefits when you remortgage and you will find yourself much better off per month the more you pay off your loan.

- Con: Your monthly payments are higher than with an interest-only deal

Pretty self-explanatory. As you are paying the capital and interest per month your repayments would be a lot higher than a purely interest-only loan.

- Con: You only pay a small amount of your debt off in early years

Because only a small amount of the mortgage is paid off in the early years, if you were to move again in those early years it is likely that you would need to take out a new 25-30+ year repayment mortgage, in order to make monthly repayment amounts manageable.

Now let’s look at the potential pros and cons of interest-only mortgages:

- Pro: Cheaper, more manageable monthly payments

Because you are only paying the interest on the loan and not paying off any of the capital, your payments will be much lower. For people who want to keep their monthly costs down, this could be very beneficial.

- Pro: In cases where you have an interest only mortgage on a buy-to-let. The low monthly payment will leave a larger profit for you per month from your tenants rent.

Why are buy-to-let mortgages interest-only? Interest-only loans are definitely favoured by buy-to-let mortgage clients simply for this fact. If you have a mortgage on your rental property that costs you £300 a month in interest payments and your tenant pays you £700 a month that is a large profit which ultimately is why you got into the buy to let game in the first place!

- Pro: If lenders lower their interest rates you can transfer on to the new rate fairly easily and end up paying even less per month.

With a repayment mortgage you pay the interest rate set by the lender, but you will always have to pay the repayment capital part of the loan. With an interest-only loan, if the lender decides to drop their rates and you move on to the lower rate you will just pay the interest as the rate stands meaning that your monthly payments will be even lower.

- Con: You will need to pay off the full amount borrowed in one go

Because you haven’t paid off any of the loan capital, you will still have the whole mortgage to pay back when the term ends. So if you get a £300,000 mortgage in 2022 for 30 years…..you will still have a £300,000 mortgage in 2052 to pay back.

- Con: You will pay more interest because the loan amount stays the same

As we mentioned above, with repayment mortgages your mortgage balance goes down so therefore the interest on the loan balance will also decrease. However, with an interest-only mortgage, your capital does not go down, so you always pay interest on the full loan balance.

- Con: You could end up out of pocket if your repayment plan underperforms

When getting an interest-only mortgage you will need to plan for the future. Your advisor should help you to plan how you will eventually pay off the balance of the loan at the end of the term. There are several ways you might plan to do this:

- Withdrawing the required amount from your savings

- Selling investments such as stocks and shares

- Drawing down a lump sum from your pension fund

- Selling the property (hopefully for a profit)

- Taking out another mortgage (repayment or interest-only)

Unfortunately, if you do not plan well or if your plan doesn’t exactly go the right way you could be stuck in a sticky situation. If you do not manage to save enough money over the 25-30 years, then paying off the mortgage from your savings won’t be feasible.

If your stocks and shares investments aren’t performing well, you might not have enough to clear the mortgage balance.

If your pension does not have enough in it or you are unable to access your pension for any reason, this could be an issue.

If you decide to sell the property but it has decreased in value or needs expensive works carried out, then you may be in the red financially.

By the time your mortgage runs out in 25-30 years you could well be in your 50s/60s or 70s so your new mortgage options could be very limited.

- Con: Some lenders require larger deposits for interest-only mortgages

Because none of the capital is being returned to the lender, well at least for 25-30 years, the mortgage lender will often impose some restrictions on the loan for insurance. It is common for the mortgage lender to restrict the loan they are willing to lend to 80% or below meaning that you may need to put down at least 20% deposit. With a capital repayment you could potentially put down as little as 5-10% deposit.

Are All Buy-To-Let Mortgages Interest-Only?

No. Buy-to-let mortgages can be interest-only, capital repayment, or a combination of the two although some lenders will only offer interest-only buy-to-let mortgages! As mentioned above, most people who are getting a rental property mortgage decide to choose an interest-only mortgage as they want to make as much profit from the property as possible. But it’s perfectly reasonable for someone to get a repayment mortgage on a buy-to-let if they don’t mind making less profit as it means that they will own the property at the end of the mortgage term.

Part Interest-Only/Part Capital Repayment Mortgages

Another option when getting a new mortgage is opting for a part and part mortgage. This is a great solution if you are in two minds about which route you want to go down, especially in areas of the country where property prices are higher and mortgage balances follow suit such as London.

With a part and part mortgage you can assign a certain amount of the loan balance to interest-only and a certain part to capital repayment. This option will enable you to have the best of both worlds with lower payments per month but the ability to pay off some of your loan although you will still have the interest-only part to pay back at the end of the mortgage term.

If we use the example loan above again of £300,000 you could put £150,000 on interest-only and £150,000 on capital repayment over 30 years at 2% interest. The capital repayment part would cost you £554 a month and the interest-only part would be £250 a month so in total your £300,000 mortgage would cost £804 a month. So, you can see why this might be a better option for larger mortgages to keep your cost down but still repay capital.

Conclusion

Choosing the right type of mortgage really is something that shouldn’t be taken lightly and without the help and guidance of a specialist mortgage professional, you could end up paying more than you can manage, losing money on your investment property, or getting stuck with a large mortgage balance and no repayment vehicle planned. What is better, repayment or interest-only? I’m afraid there isn’t a definitive answer to that question but let your mortgage advisor help you to decide on the best option for your circumstances.

So, if you, like thousands of others are unsure about whether you want an interest-only or capital repayment mortgage or just want to talk to a friendly expert about your options, please give our team a call. We are always available for a chat to get your finances in order.