The Mayor of London Sadiq Khan has come out this week to demand that a citywide rent freeze be imposed as inflation and the cost of living begins to ramp up. A rent freeze would mean that landlords and other businesses and organisations that let out residential properties would be unable to increase monthly rent charges for their tenants.

The mayor’s intentions with this would be that thousands of struggling households in the capital would would still be able to live in their rented properties and keep up with their current rent commitment without having the fear of their monthly bill spiralling out of hand. That, of course, is a very caring preposition for the mayor to make for Londoners but, what about the owners of the properties?

Is There Such A Thing As A Struggling Landlord?

I think that the general public has a sweeping stereotype in their minds that all landlords are multi-millionaire property barons who don’t need the money and charge their tenants rent just for the fun of it. This is obviously not true. Yes, there are property magnates who could survive without increasing rents, and you are more likely to find these types in London if anywhere. However, the majority of buy-to-let landlords are not mega wealthy and often let their properties out of necessity.

What I mean by this is that sometimes rental properties are the only source of income for a person or a family if they are unable to work or possibly they don’t earn enough in their 9 to 5 job and need the rental income to support their family. A rent freeze across the capital, where the cost of living is high for everyone, would see rental property owners struggling to make an income, struggling to pay their mortgage, and ultimately going through worse financial hardship than a lot of their tenants.

What Has The Mayor Said Exactly?

In his statement to the press, Khan has said that the rising rent prices in the capital is a ‘disgrace’ after rent rose 15 percent in the last year. The average rent in London is currently £815 a month, compared with an average of £708 in 2021. I understand completely the Mayor’s frustration and 15% is a lot for rent to increase by but disgrace is a rather strong term for exactly the reasons I have mentioned above.

As the cost of living goes up, mortgage lenders increase interest rates, energy bills increase, landlords who rely on the income from their rental properties are increasingly finding themselves out of pocket. To many, the only option is for a rent increase. Unfortunately for some properties in some areas, this means that in order to keep the wolf from the door, landlords are having to increase the rent by a lot more than they or the tenants would want.

But on the other hand, how do we tackle these rogue landlords that Khan rightly has a vendetta against? The landlords who don’t need to increase rent but do anyway to make as much profit as possible? That is a question for the government to address. Hopefully sooner, rather than later!

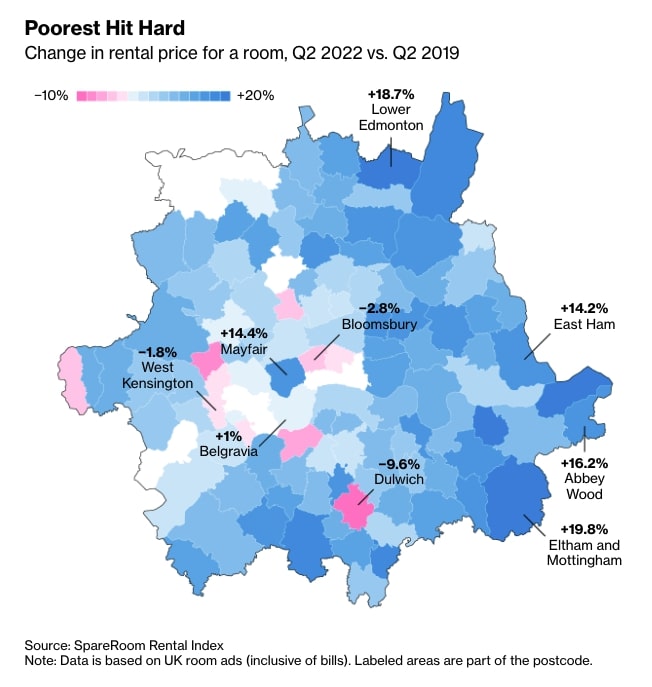

Areas of London affected by rent increases (source: SpareRoom rental index)

What Can Landlords Do To Avoid Raising The Rent?

What can the average Joe landlord do to avoid increasing their rent and pricing out their already struggling tenants? Because ultimately, that is what most landlords want to avoid doing. The absolute best thing you can do in our opinion is, if you have a mortgage on the property, get in touch with your mortgage advisor immediately.

As a specialist buy-to-let broker, Oportfolio are offering free financial health checks to all of our client (new and old) where our advisors will take a look at all of your finances and the details of your mortgage to make sure that you are getting the most out of your finances. With rental properties, that includes making sure that your current mortgage is on a good rate or good payment structure so that the rent you receive is able to pay your mortgage and all other necessary monthly payments as well as making you a worthwhile income.

Currently there are thousands of mortgage owners who are on the wrong deal or have fallen onto the standard variable rate and are completely oblivious to it. By speaking to a specialist advisor, you can take back control of your mortgage, your property finance and your livelihood.

If you are a landlord and are struggling to juggle your buy-to-let mortgage, cost of living, and rental income, please feel free to give our advisors a call to run through a financial health check today.