Mortgage News, Insights & Advice

All the latest UK mortgage news, insights and advice from the world of mortgage lending and Oportfolio

How To Become A Property Developer

Thinking of becoming a property developer? Bravo. According to a 2023 article in The Big Issue, there are around 261,000 empty or abandoned homes in the UK. Yes there is a housing crisis in England, but with over 200,000 empty properties in desperate need of...

NatWest Introduces High Value Mortgages In New Business Range

NatWest has announced significant changes to its New Business product range, set to take effect from the 30th of April 2024. These changes include the introduction of new high value mortgages intended for customers seeking to purchase or remortgage properties that are...

TSB Landlord Mortgage Rates Raised

In a message released this morning, and following in suit with other UK mortgage lenders, TSB has announced significant changes to its mortgage rates, affecting both residential homeowners and buy-to-let landlords. The bank revealed plans to withdraw certain mortgage...

Coventry Raises Mortgage Rates: What You Need to Know

Coventry Building Society has recently announced changes to its mortgage rates, affecting both new and existing borrowers across various categories. In a communication sent out to Oportfolio mortgages today, Coventry have announced several rate increases. Here's a...

Epic Mortgage Rate Revolution: How We Saved Clients Thousands

In the fast-paced world of mortgages, timing is everything. As an experienced mortgage broker, we pride ourselves on staying ahead of the curve and ensuring our clients secure the best possible deals. Recently, we embarked on a mission to proactively review and adjust...

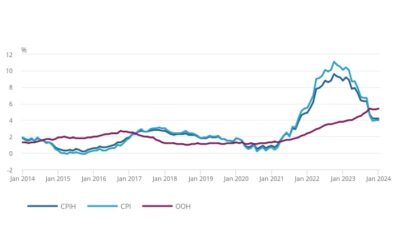

UK Inflation Steady at 4%: Impact on Mortgage and Property Market

UK headline CPI inflation has maintained its position at 4%, in line with December's figures, defying expectations for a rise to 4.2% according to many economists. The January 2024 data released by the Office for National Statistics (ONS) indicates a monthly price...

UK Mortgage Rates Surge as Lenders React to Bank of England

In the wake of the Bank of England's recent decision to maintain its base rate at 5.25%, the UK mortgage market has experienced a wave of volatility. Lenders have swiftly responded by adjusting their fixed-rate deals, anticipating prolonged stability in interest...

Nationwide Raises Mortgage Rates as Santander Slashes Them – Rate Adjustments

This week Nationwide and Santander have announced adjustments to their residential mortgage rates, slated to take effect from today. These rate adjustments aim to cater to evolving consumer demands and market conditions, but the raising of rates seen is certainly...

Never Considered Harpenden Building Society For a Mortgage? Why Not?

When looking for a new mortgage, the landscape can often seem dominated by the big names, leaving smaller institutions overlooked. I’m talking the Halifax, Santander, NatWest, and Nationwide of the mortgage market. However, delving into lesser-known lenders like...

UK Property Market Bounces Back: Surprising Trends Revealed in January 2024 Report!

The latest findings from the Royal Institution of Chartered Surveyors (RICS) UK Residential Market Survey for January 2024 indicate a promising turnaround in the UK property market. Positive shifts observed in key things such as buyer demand, agreed sales, and new...

Halifax Announces Exciting Rate Reductions of Up To 0.53%

In a move that's sure to make waves in the housing market, Halifax is shaking things up with some exciting changes to its product range. Effective from Thursday the 1st of February 2024, the following modifications are set to give homebuyers and homeowners more...

How We Helped a 63-Year-Old to Keep £2 Million in His Pension While Buying a Property

Meet our client who discovered us on Google - a 63-year-old, semi-retired individual with a whopping pension pot exceeding £2 million. His dream? To own a new home to enjoy his retirement years, without depleting his pension savings and strategically navigate the...

Virgin Money Introduces Fix and Switch Mortgage Offering

In a response to the increasing uncertainty surrounding mortgage rates, Virgin Money has unveiled an innovative Fix and Switch mortgage offering, designed to provide customers with a unique combination of stability and flexibility in a challenging mortgage market. In...

UK Housing Market Soars as House Prices Surge in Early 2024

It seems that the UK housing market has experienced a remarkable upswing in the initial weeks of 2024. Recent reports indicate a substantial 13% increase in new sales agreed, showcasing a robust market rebound driven by pent-up demand and the enticing drop in mortgage...

What Is Income Multiple Calculation for Mortgages?

As mortgage brokers, we encounter a common question from prospective borrowers: "How much can I borrow?" Many individuals rely on the widely circulated notion that they can borrow up to 4.5 times their income. However, this oversimplified rule is just the tip of the...

We're Here to Help

If you have any questions about UK mortgage news or anything you’ve read then please get in touch. We’d love to hear from you.