Do you need a self-build mortgage?

Self Build Mortgages Explained

Do you like the idea of building your own home from scratch? A house that is completely your own design, that fits your unique style and wants and needs? For many people, building your own property from the ground up is the dream. But where do you start? If you aren’t one of those lucky few who can afford to pay for and build your home without the help of a bank, chances are that you may need a self build mortgage. UK banks can support people building their own homes with loans that provide cash injections at different sages so that you can ensure that you have a constant flow of cash to complete all the work needed.

With the help of a qualified self build mortgage broker, you can get the best self build mortgage, the best self build mortgage lenders, the best self build mortgage rates and most importantly your perfect home designed and built by you.

How Do Self Build Mortgages Work?

So, how does a self build mortgage work? It is quite similar to regular mortgages in a way but aimed more at providing you with cash at different stages rather than a lump sum at the end. Where a normal mortgage will release the full funds to you at the end of the purchase process so that you can buy the property off of the vendor, a self build mortgage can release the loan to you bit by bit, when you need it.

For example, you can potentially be approved for a £500,000 self build loan. If you haven’t yet bought the land you could have £100,000 released at the beginning of the process to purchase the land. Then a further £200,000 to break ground and lay foundations and pipes etc. Then a further £150,000 to build the property and finally the remaining £50,000 to complete the property.

If you want a self build mortgage, already own land, and have architectural plans drawn up then you are in a great position to start getting cash in place through a broker. However, unlike normal mortgages, lenders will require much more documentation relating to the actual construction of the property to ensure that the money is being used correctly, that the property is being built correctly, and that you are doing everything above board. When securing a new mortgage for self build homes, it is important that you have the right experienced mortgage advisor who can guide you through all the requirements. Don’t try to arrange the mortgage on your own.

Self Build Mortgage – How Much Can I Borrow?

You might be surprised to learn, but self build mortgage affordability criteria is quite straight forward. It is more or less the same as when you get a normally mortgage as the lender’s are more concerned about the construction of the property and your ability to pay back the money they have lent you. Generally lenders will be willing to lend between 4X and 5X your annual salary. This figure changes depending on your current credit commitments, your age, and dependents. To go through a full self build mortgage affordability check, speak to our in-house self build mortgage advisor today.

How To Get a Self Build Mortgage

Even if you are toying with the idea of a self-build mortgage and haven’t fully committed yet, the best thing to do and the best place to start is with a quick call or meeting with a mortgage advisor. Give our team a call or drop us an email for a free initial mortgage assessment with one of our brokers to find out what may or may not be possible and how to get the ball rolling.

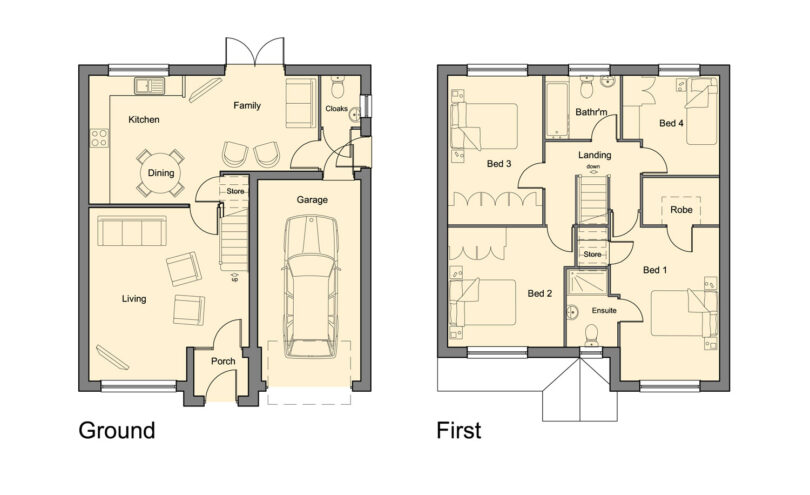

Mortgages for self build homes (Source: self-build.co.uk)

Self Build Mortgage Providers

As you might have already guessed, a self build mortgage is quite a specialist type of loan and there are lots of things that need to be taken into account. Because of this, a lot of the main high-street banks will not provide mortgages on properties that you are building yourself. In this section we will go through some of the most popular mortgage lender’s stances on providing a mortgage for a self build property. This is not an exhaustive list, and through a whole of market broker like Oportfolio, you can have access to many more lenders.

Halifax Self Build Mortgage

Here is Halifax’s current criteria around building a property yourself and getting funding from a mortgage:

Additional documentation required aside from the normal mortgage documents

- Schedule and cost of works to be provided by the supervising consultant/builder. This should include confirmation that any abnormal costs associated with the site and a contingency of not less than 10% has been factored into the costs.

- Full planning consent, planning authority approved plans and a plan outlining the boundaries of the proposed security and access to and from the development to the highway.

- Confirmation that appropriate insurance is in place during the construction of the property.

Additional self build criteria

All full applications will be referred to an underwriter for review. Customers can only have one pending Self Build application with Lloyds Banking Group. Product transfers, term and repayment type changes and Transfer of Mortgaged Property changes will not be allowed until the property build is complete. Customers can apply for a Self Build mortgage on Interest Only where a suitable repayment vehicle is in place. Existing Halifax customers cannot port their existing mortgage product on to a self build mortgage. Product fees can be added to the loan amount.

LTV/Loan size

Loan to Value – Maximum of 75% of the final value of the property and the loan must not exceed the combined costs to buy the land and build the property.

Loan Size – up to £1million.

Stage payments – Funds can be released in a maximum of 5 instalments. We usually release the money at the end of the following 5 stages:

- Land Purchase

- Footings and Foundations

- Construction of the walls (Wall Plate Level)

- Roofed In

- Internal/Final Completion

The initial advance can be up to a maximum of 75% of the current value. Where funds are being released for land purchase it must also not exceed 75% of the price of the land paid by the applicant. Where all the land has been gifted the first instalment will not be released until footings and foundations stage has been reached.

When the construction reaches the appropriate stages, further releases up to 75% of the current value, less the total amount already released, can be considered. However, for the penultimate stage release, at least 10% of the total loan will be retained, as a final release, until the property is complete and we are in satisfactory receipt of the final completion certificate, irrespective of the ability to release more based on the interim value.

Security

Properties must be for main residential use only. Second properties, holiday homes or properties which will be let are not acceptable. We only accept Detached Properties. Refurbishments and conversions will not be accepted. No usage or occupancy restrictions are permitted.

We will not accept situations where the land is being or has been separated from either:

- Surrounding/adjoining land which is in the ownership of the applicant or their family

- A commercial venture owned by the applicant or their family

No remortgages of properties already under construction.

No applications for properties under construction where the applicant is not the original owner.

Applications may be considered where the customer is acquiring land with an existing property already in situ which is being demolished to make way for a new property. Where this occurs, the supervising consultant/developer must reflect any clearance and/or abnormal costs associated with the demolition within the schedule of work and costs provided.

Where the customer is the original owner and has commenced the build, this may be considered provided the build is not further than footings/foundations level.

The building project must be managed by either a builder or an independent supervising consultant and they must meet our building control and monitoring requirements i.e an acceptable Buildings Standards Indemnity Scheme or meet the requirements for the self build to be ‘Consultant Monitored’.

If you are interested in Halifax self build mortgages, give our team a call.

Virgin Self Build Mortgage

Virgin money do offer this type of loan. Here is Virgin Money’s self-build criteria:

Virgin Money does not accept self build or custom build properties whilst they are undergoing construction and the property is not in a habitable condition.

Virgin Money will accept a self build or custom build property once construction is complete and the property is in a habitable condition. This is subject to the property having the benefit of a new build warranty or professional consultants certificate in the standard CML format, acceptable to Virgin Money, and a satisfactory valuation report and valuer comment.

The Virgin Money definition of a property being habitable is:

- Wind and weather tight

- Plastered out

All services functioning and connected with at least one:

- Kitchen with functioning hot and cold water supply to a sink and adequate food preparation and storage facilities

- Functioning bathroom with bath or shower and WC

Bath Building Society

Bath do provide self build loans. Here is a breakdown of their criteria:

- Maximum loan £1,000,000 cut to £300,000 for first time buyers

- 40 year maximum mortgage term

NatWest Self Build Mortgage

NatWest do not currently offer self-build mortgage deals but like Nationwide, they do offer a wide range of finance options for new build purchases.

Santander Self Build Mortgage

Santander do not offer self-build loans. There are plenty of other lenders who do however. A qualified and experienced mortgage advisor will be able to guide you toward the right one.

Nationwide Self Build Mortgages

Nationwide unfortunately do not currently offer self-build support, however they do have plenty of options for financing new build purchases such as buying a property direct from a developer or financing a recently converted and refurbished property. If you are looking for a self build mortgage, Nationwide is not the lender for you, but there are plenty of others to choose from.

Barclays Self Build Mortgage

Barclays bank will not currently accept self-build mortgage loans of any kind. But there are plenty of other lenders that will.

RBS Self Build Mortgage

As an arm of NatWest, RBS (Royal Bank of Scotland) will not accept self build mortgages either.

Self Build Mortgages HSBC

HSBC do not offer self build mortgages.

Getting the best self build mortgages

Government Self-Build Scheme

The government provide a ‘Help to Build’ scheme, available to people looking to get stuck in and build their dream home.

Off the back of the success that the help to buy scheme has seen from 2013 to 2023, the government has pushed other initiatives such as the shared ownership scheme to offer other alternatives to straight mortgaging a property. Announced in April 2021, the help to build scheme is one of these initiatives conjured up by the government. Designed to act in a similar way to the help to buy scheme, the help to build scheme is aimed at people who want to build their own property rather than go for an art attack “Here’s one I made earlier” property built by a commercial home builder.

Self Build Mortgage Deposit

In a nutshell, here is how the scheme works according to moneyfacts.co.uk: ‘The scheme provides £150m in the form of loans to those wanting to get a self-build mortgage. On average, self-build mortgages (excluding remortgages) in England and Wales have a maximum loan-to-value (LTV) of 70%. The Help to Build Loans are expected to help reduce the buyer’s deposit down to 5%. However, the loan is not expected to be available upfront and could instead only be released to the lender when the self-build project is completed. The expectation is that the scheme will help to free up cash towards build costs and help borrowers to get a better mortgage interest rate due to having a larger deposit.’

“Interest Free Mortgages For Self Build”

The equity loan will be interest-free for five years and then you will start paying interest on the loan from the sixth year. On year six interest will be added at a fixed rate of 1.75%. From year seven onwards, the previous year’s interest rate will increase by 2% plus either the Consumer Price Index (CPI) rate or a minimum of 2% if the CPI is zero or less. Along with repaying the loan and interest, borrowers will be charged a £1 monthly management fee for the life of the loan. Borrowers will have to repay the loan at the end of the term, which is normally 25 years, or when they sell the home or pay off the mortgage. Alternatively, the loan can be repaid any time before then.

Can A First Time Buyer Get a Self Build Mortgage?

The simple answer is yes, yes they can. However as with a lot of first time buyer loans, there may be some restrictions that could mean that not every lender will be willing to lend you a self build mortgage, and you may not be able to get the loan that you need. Factors such as income. First time buyers generally have lower incomes. Deposit. Without using any schemes, deposits for self build homes are normally a minimum of 25% or more. And credit history. Lenders will do a vigorous credit search for self build mortgages, especially first time buyers, to reduce the risk factor of lending. Many first time buyers do not have much of a credit history, so this could hinder the mortgage application.

How Much Deposit For Self Build Mortgage?

As we have already mentioned, unless you are making the use of the government ‘Help to Build Scheme’, you will more than likely need at least 25% deposit if not more. This is more than most lenders will require for standard non self build loans because the risk factor of lending on a house that hasn’t yet been built is much higher than lending on a house that has been lived in for several years.

A lot of lenders will offer up to 95% mortgages for standard property purchases and remortgages, however there are no 95% or 90% ltv self build mortgages. There may be a lender who will offer 85% or 80% ltv but your mortgage advisor will have to do the research for you to find out if this will be available to you.

Self Build Mortgages UK

If you or someone you know is thinking about building their own property and needs to discuss finance options, please feel free to give our advisors a call today. We are here to help.