Help to buy example (Source: Berkeley Group)

And just like that, one of the UK’s most successful house purchase schemes has come to an end. The help to buy scheme, which has helped people purchase their dream new build house for almost 10 years has finally finished. In this article we will take a look back at some of the amazing things that the help to buy scheme has achieved over the last 9+ years and also some of the schemes that are still available to help with home purchases.

What Is The Help To Buy Scheme?

The scheme was introduced to the new build (newly constructed or converted properties) market in 2013 after several years of development. Essentially the scheme offers buyers the chance of being able to purchase a new build property with as little as 5% deposit. The government help to buy agent would also contribute 20% of the value of the property towards the purchase, in the form of an interest free loan. In London, due to higher property prices on average, the scheme contributes 40% of the property price. So, if we look at some real figures, the scheme could look like this:

Purchase price: £250,000 (100%)

Deposit: £12,500 (5%)

HTB Loan: £50,000 (20%)

That means that the borrower would then have 75% of the value of the property left to finance, which would be done through a help to buy mortgage which they would pay back per month. Because the borrower only needs to put down 5% deposit and get a 75% mortgage, the purchase is often a much more beneficial and affordable way for people to buy, especially first-time buyers.

Now, the interest free loan from the government will need to be repaid at some point however, the government would allow you to pay back the loan at any time over 25 years. They would also allow you to repay it in either one lump sum or in two halves. That means that you could essentially pay back 10% of the loan in 12 years and the other 10% in another 12 years.

What Is Happening To The Help To Buy Scheme?

When the scheme (Full name Help to Buy shared equity), was initially introduced in 2013, it came with a shelf life of 3 years initially. It also can with another scheme called the HTB mortgage guarantee scheme, where people would basically be guaranteed a 95% mortgage with the backing of the government. In 2016, the HTB mortgage guarantee scheme was discontinued but, due to its huge success and popularity, the HTB shared equity scheme was extended to 2020 with a review set to take place then. For the next 4 years, the scheme continued pretty much as it had before.

In 2020, the government announced that they would be extending the scheme again until 2023 but with some major changes. The government changed the rules so that only first-time buyers could use the scheme and they also reduced the maxim property purchase price that you could use the scheme on. To many, this was an obvious sign that they were setting the wheels in motion to wind down the scheme.

Many mortgage brokers and housing developers were wondering if the scheme would be extended again but it soon became clear that the intention of the government was not to extend the scheme and they announced that the deadline for submitting new HTB applications would be the 31st of October 2022 with the final completions taking place in early 2023. And just like that, the scheme has come to an end.

Was Help To Buy Successful?

In our opinion, the scheme was a huge success, and this is evident by the sheer number of people that it has helped to buy their own property. There is a property crisis in this country and traditional, hardworking buyer are often being priced out of the market by investors and higher earners. The scheme has given a lot of people the otherwise unattainable opportunity of home ownership and was a very good move. Below are some of the figures to illustrate how much of an impact the scheme has had in the property market.

- 291,903 properties were bought under the scheme from 2013 until 2021.

- 82% of all completions were by first-time buyers.

- £17.4 billion worth of HTB loans have been provided to borrowers.

- £79.2 billion worth of property has been bought due to the scheme.

- 33% of Help to Buy completions were for homes worth £200,000 or less.

- Around 46% of properties had a purchase price ranging between £200,001- £350,000.

- 21% had a purchase price greater than £350,000.

- 52% of the homes purchased had a price of £250,000 or less.

- 56% of properties had a value of £250,000 or less when it came to first-time buyers.

- 51% of borrowers had household incomes between £20,000 and £50,000.

- 2% of applicants had household incomes below £20,000.

- 5% of applicants had household incomes above £100,000.

- The majority of first-time buyers had household incomes ranging between £20,000 and £50,000.

What Come Next?

So far, the government have not announced any particular scheme to replace HTB. Which was and still is a shock to us as mortgage advisors. As we have already made clear, the HTB scheme was a massive success, and we find it difficult to believe that the government will leave such a large gap in the market by getting rid of the scheme. Thats why we expect that they are currently working on a replacement and will announce something in late 2023 or 2024. Whether that will be another variant of the previous scheme or something completely different, only time will tell.

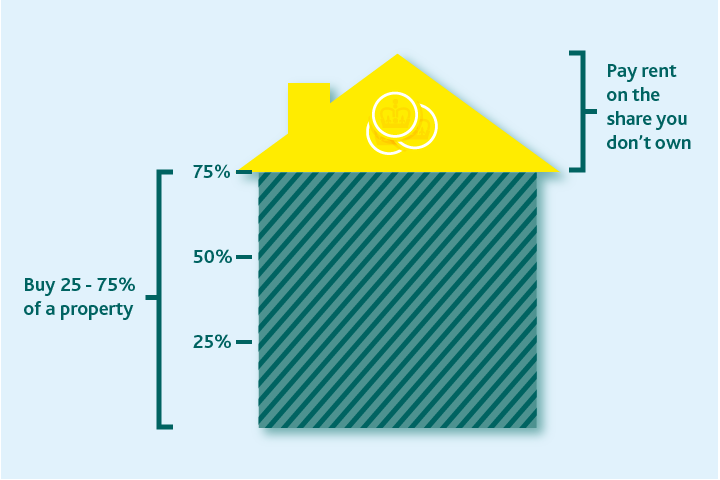

Currently the next most popular scheme used by buyers is the shared ownership scheme, and we expect to see a huge increase in people purchasing using the scheme. Shared ownership allows you to purchase a share of a property rather than 100%. The other shared that you have not purchased is owned by a housing association or a similar group and you would pay rent to them for the share you don’t own. The share you do own can be mortgaged so you would essentially pay a mortgage per month for your share and rent per month for the other share.

Example Shared Ownership Figures

Shared ownership example (Source: Foxtons)

Full price: £400,000 (100%)

Minimum share purchased by buyer: £100,000 (25%)

Minimum deposit provided by buyer: £5,000 (5% of share)

Mortgage required: £95,000 (95% of the buyers share)

Monthly mortgage payments over 30 years: £600 (based on 6.5% interest rate)

Monthly rental payment for remaining 75% of property: £688 (based on a 2.75% rent rate)

Total monthly payment for a shared ownership property: £1,288

Total for a 95% straight mortgage for comparison: £2,402

So, you can see why the scheme is so popular and especially in areas such as London where the average price of a house is over £500,000. Also, like the help to buy scheme, shared ownership can allow borrowers to put down a much lower deposit that a straight mortgage. If we look at the figures above, a standard mortgage will demand a minimum of £20,000 deposit on a £400,000 purchase. With shared ownership and purchasing a 25% share, a buyer could put down as little as £5,000 potentially.

Goodbye To Help To Buy

Well, that’s it then. Goodbye to help to buy. Having started my career in new build mortgages, HTB has been a big part of my learning and development in the mortgage world and I am sad to see it go. It does trouble me a little that no clear successor has been announced but I have faith that the government won’t simply leave borrowers and the new build market without any help after stopping the scheme. I predict that we will see a new scheme introduced within the next couple of years, but who knows if there will ever be such as successful housing initiative as help to buy.

If you or anyone you know is interested in shared ownership or any other house purchase scheme, please give our advisors a call today to see how we can help. And, if you already have a help to buy loan and need to discuss paying it back, our advisors are on hand to help with anyone looking to remortgage to pay of help to buy. Call us today.