As financial advisors, we at Oportfolio make it our mission to ensure that all of our clients receive the best possible mortgage and protection advice that not only benefits them but benefits their family and loved ones too. Getting adequate life insurance, critical illness cover, and income protection in case something happens is very wise. Without protection you and your family could find yourself in financial hardship through no fault of your own. In this blog, we will highlight the importance of insurance and a couple of real life stories where clients did not follow advice and ended up unfortunately paying the price.

Case 1

A couple purchased their first home and took out a large mortgage. As part of the process and ensuring that their clients were adequately insured because of the large loan, their financial advisor advised that they take critical illness cover or CIC to match their mortgage exposure. Critical illness cover will provide a person with a lump sum payment if they are diagnosed with a critical illness that could prevent them from working. These are things like cancer, or a stroke, or Parkinson’s disease.

Despite being quoted a very manageable monthly premium for the insurance, the clients declined to take up the full CIC because they thought it was too expensive. Still stressing the importance of insurance, the advisor re-structured the cover so that instead of having full CIC for each client, they provided them with full life insurance which would provide a pay out if one of them passed away suddenly and half CIC for each applicant to cover their half off the mortgage.

That would mean that if one them was diagnosed with a critical illness, half the mortgage would be paid off or, the money could be used for other things to keep everything going financially. They still said that the cover was too expensive for them, despite the advisor carefully calculating their manageable monthly premium amount. One of the clients was medically classed as overweight, and they believed that they would lose weight in the future and this would mean that their insurance cover would go down.

Two years later, one of the applicant’s parents was diagnosed with cancer. When the parent found out that the clients had not taken up any insurances, he insisted that they get some in place. When the clients approached the advisor to arrange some insurance, the monthly premiums were even more expensive! This was because:

- Because a parent had been diagnosed with cancer, the clients were now deemed as higher risk of developing cancer themselves than before.

- Despite saying they would, the clients had not lost any weight.

- Because they waited two years, they are now older so the monthly premiums have increased with their age.

The moral of this story is that the clients, despite receiving the best possible advice and being quoted the best possible products on the market, did not believe in the importance of insurance and have now had to pay even more than they were initially quoted to receive the same cover.

Case 2

The next story is a sad example of how someone prioritised other things over their protection despite having really good and comprehensive cover in place.

This client took the initiative to arrange insurance for themselves a few years ago, covering things like critical illness and income protection in their policies and happily paid the monthly premiums as they were a carefully assessed and calculated amount arranged by their advisor. Unfortunately last year the client called the advisor to cancel their protections. They decided to do this to save money and because they were only in their 30’s, they thought that they were unlikely to ever need to use the insurances.

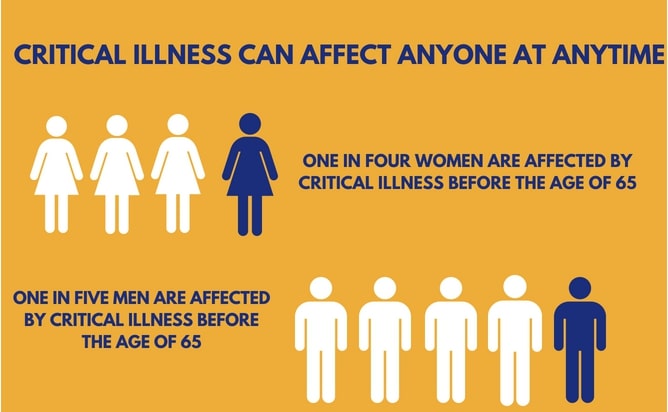

Sadly this client had a brain aneurysm out of the blue recently and has been severely ill and incapacitated as a result. The severity of the aneurysm has meant that the client is unable to move, feed themselves, or communicate very well. The likelihood that they will ever recover enough to be able to return to full time work is very slim and the costs of their treatment and the fact that their household has now lost half of its income, means that costs are starting to rack up.

The Importance Of Protection (Source: www.mccreafs.co.uk)

Because the client can’t communicate, their parent called the advisor to see what insurances they had in place and sadly they had to inform them that the client had cancelled all of their insurances the previous year. The money that they would have received from the insurances would have made a great difference to the client and their family but unfortunately because they had cancelled it, there was nothing in place.

The moral of this story is that despite what you might think, these things do happen. And they can happen to anyone, young, old, healthy or unhealthy. Hopefully insurance is never needed – but if you make sure that you have something in place, it makes a very stressful and awful situation that little bit more manageable.

If you are part of the 3 million UK households that don’t have any protection in place, please consider your options and consider the stories we have explored today. Despite what you think, speaking to an advisor and arranging you protection through them will save you money and make sure that you and your family are covered in case anything happens. Call our team today to learn more about the importance of insurance and to see how our advisor can help.