UK GDP Increased by 0.2% (Source: www.ons.gov.uk)

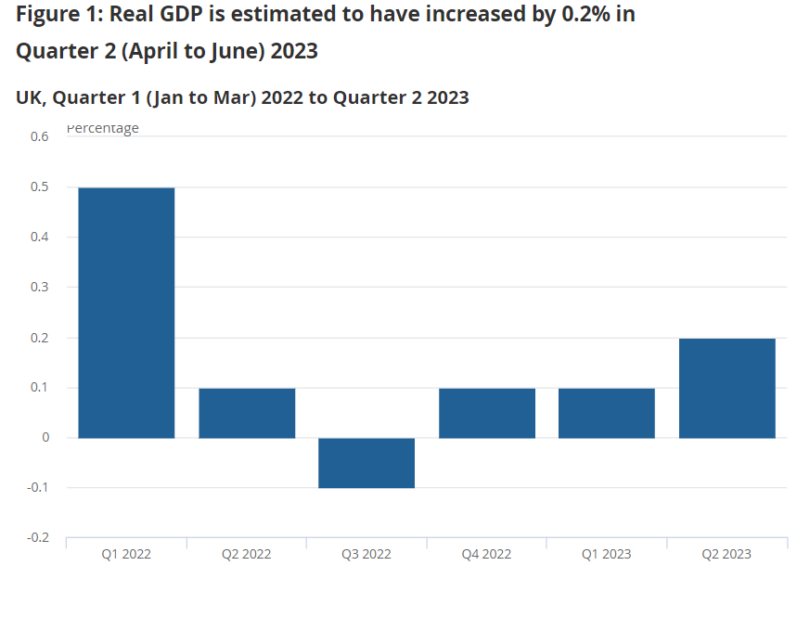

In a much anticipated update, it seems that the United Kingdom’s economic landscape has show signs of recovery as the real gross domestic product (GDP) experienced a small growth of 0.2% in the second quarter of 2023, spanning from April 2023 to June 2023 according to the Office of National Statistics. This encouraging data comes to light as the first quarterly estimate was unveiled on the 11th of August 2023.

UK GDP Growth Recorded

An analysis of the monthly figures shows that the UK’s GDP surged by a notable 0.5% in June 2023, marking a rebound from the 0.1% dip recorded in May 2023. This June increase followed a 0.2% growth in April 2023. Despite these gains, the economy is still below its pre-coronavirus level in the fourth quarter of 2019 by 0.2%. A comparison with the same quarter a year ago does however show a 0.4% rise in the GDP estimate.

According to the ONS, the primary driving force behind this quarter’s growth could be attributed to the services sector, which lead the increase with a 0.1% improvement on the quarter. Within this sector, progress was seen in information and communication, accommodation and food service activities, as well as human health and social work activities. The production sector also played a vital role by contributing a significant 0.7% to the overall growth, largely fuelled by a 1.6% surge in manufacturing. Breaking down the expenditure side, the growth narrative is underlined by robust leaps in household consumption and government spending. However, these promising advancements were counterbalanced by a dip in international trade flows during the same time span, presenting a multifaceted picture of the current economic trends.

UK Inflation Still Remains Higher Than Desired

Despite these positive figures on GDP, we all know that inflation still remains higher than desired. The Bank of England still keeps their target rate of 2% for UK inflation, however unrealistic that may or may not be. Currently the latest inflation figures for the UK sets it at around 7.9%. Much better than the 11% we saw a few months ago, but still a way from the 2% wanted.

The second quarter of 2023 demonstrates a careful balance between sectors driving growth, expenditure, and inflation. The economy’s persistent journey towards pre-pandemic levels is visible in the gradual but steady rebound that we see today. While challenges persist, including international trade disruptions due to conflicts in Russia and Ukraine and the ongoing need for cautious economic management, the latest GDP estimates offer a bit of hope for the near future.

Speak to a Mortgage Advisor

The UK’s economic landscape has show noteworthy growth in the second quarter of 2023, providing an optimistic outlook for the future. What could this mean for mortgages? Well as the economy recovers and inflation continues to drop, this should add a lot more confidence to the mortgage market in turn. We are already starting to see lenders dropping their rates and adding more competitive products to the market, and we predict that this will only continue. If you are looking to get a new mortgage, or simply want to re-evaluate your current deal, then please feel free to get in touch. Our team of friendly advisors are on hand to help. Just give us a call or drop us an email. We are here to help.