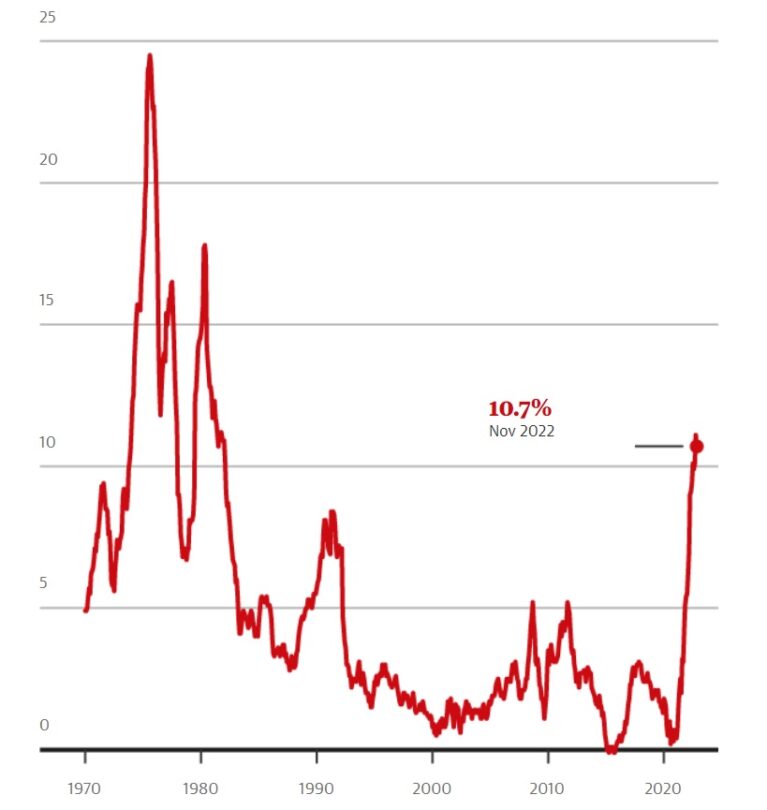

The office of national statistics or ONS have announced that UK inflation has seemingly dropped in November. A great sign that the measures brought in by the Bank of England in recent months are hopefully starting to work. Inflation is the general rise of prices and fall of the value and purchasing power of money. The Bank of England’s job is to try and keep inflation as low as possible in order to avoid a recession, however in recent months inflation has crept up and up.

As a way to reduce inflation, the Bank of England must discourage public spending by increasing the base rate of which it charges interest. In the last six months alone, the BOE has increase it’s base rate from 1% to 3% and we are expecting further rises. As the base rate rises, so does the cost of buying and borrowing so people should naturally start trying to spend less. After inflation rose to 11.1% in October, we have finally seen a drop in UK inflation as the ONS reported a rate of 10.7%. Not a huge drop but definitely a noteworthy one and hopefully a sign that the UK is heading in the right direction.

UK Inflation Graph (Source: The Guardian)

The BOE UK Inflation Aim

The BOE’s aim is for UK inflation to be at 2%, a far cry from where we are at the moment but something that is not impossible. The last time being in May 2021 after a dramatic drop during the early days of the 2020 COVID-19 pandemic. Most economists and other professionals expected that the rate of inflation would only fall to 10.9% so this drop of 10.7% is better than predicted.

Knock-On- Effect For Mortgages

So now onto the most exciting bit for us as mortgage specialists, the knock-on-effect that the inflation decrease will have on mortgages and mortgage rates. Mortgage rates increased at the end of 2022 quite substantially due to the BOE raising their base rate. In order to make lending money make sense and in order to keep making profits on their loans, banks and building societies increased their rates from 2 and 3% on average to 5, 6, 7%+.

Unfortunately this priced out a lot of potential borrowers, especially first-time buyers and buy-to-let investors. However, as the market has stabilised more recently, lenders have started to reduce their rates again and a drop in inflation should trigger a knock-on effect, even if the BOE decides to increase their base rate any further. 2023 looks like it should shape up to a bright year for property purchases and mortgage market.

If you or anyone you know is interested in looking at mortgage options for the new year, it is never too early to start the ball rolling. Feel free to give our team a call today to see how we can help you.